child tax credit september delay

The IRS released a statement about the September delays. September marked the second straight month where a technical issue delayed the child tax credit for some Americans.

Interest On Delayed Gst Payments To Be Charged On Net Tax Liability From 1st September 2020 Delayed Filing Taxes Payment

In August less than 15 of.

. 1637 27 Sep 2021. Instead 2 percent of these eligible households discovered that their payments had gone missing. IRS offered few details.

The Internal Revenue Service failed to send child tax credit payments on time to 700000 households this month and some are still waiting for their full. Due to a technical issue expected to be resolved by the September payments a small percentage of recipients less than 15 who received payments by direct deposit in July will be mailed. Getty A statement from the agency said.

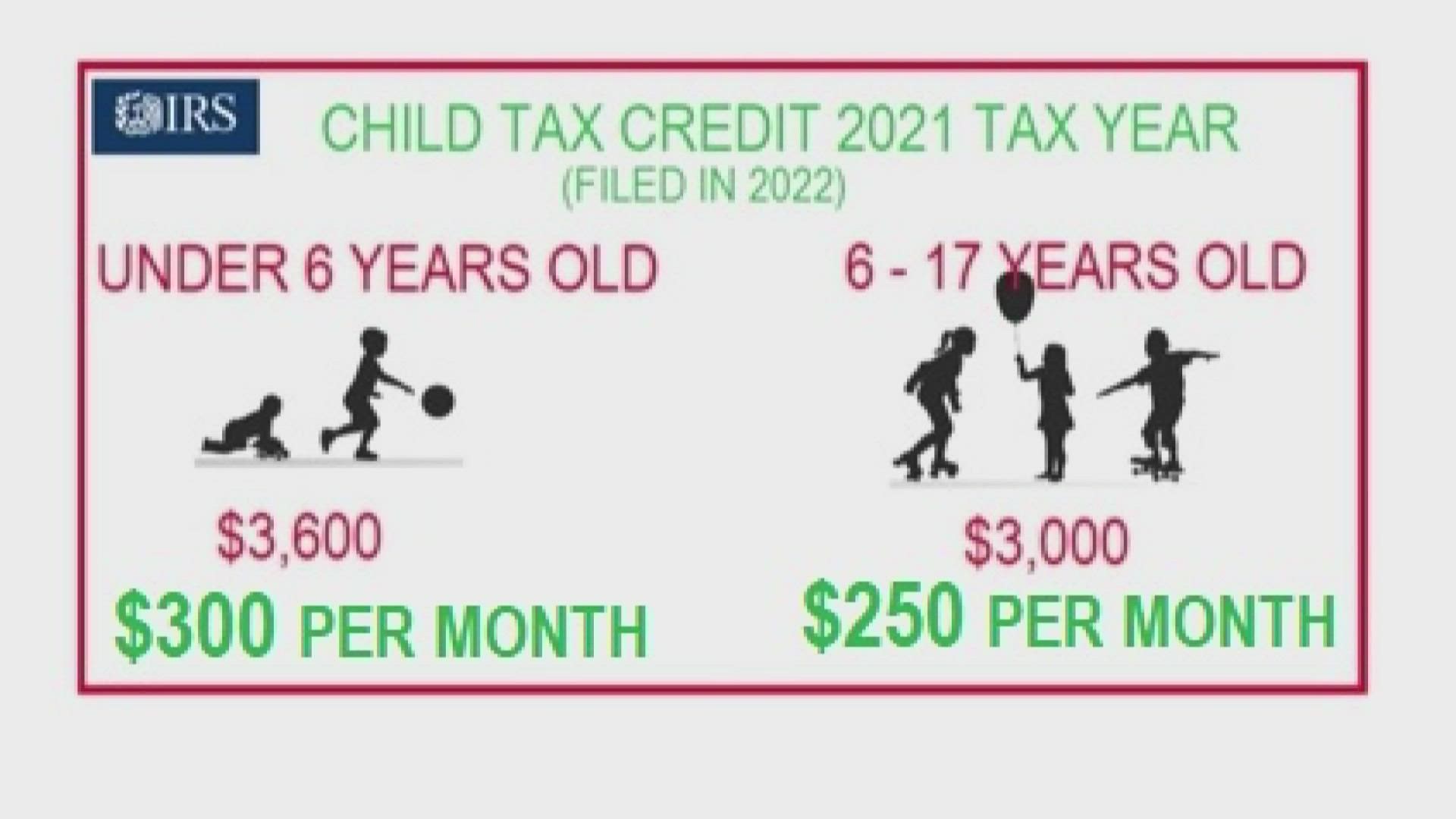

That drops to 3000 for each child ages six through 17. So parents of a child under six receive 300 per. While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept.

Oct 18 2021 1226 PM EDT. Expect money by direct deposit by Friday. Many take to online forums to post frustrations.

The IRS acknowledged a few weeks ago that there were technical problems that caused delays in the September child tax credit payments. News Sports Autos Entertainment USA TODAY Obituaries E-Edition. They were expecting to receive the monthly installment by Sept.

In fact the agency faces a backlog of more than 8. Some families are still waiting for their September child tax credit payment from the IRS. Last September 15 families that got payments in July and August should have received their third CTC payment.

Heres what we know so far. SOME cash-strapped families were left waiting for their 300 stimulus check after a technical issue caused Septembers child tax credit payments to be delayed. Delays are always possible when it comes to these payments.

601 ET Sep 29 2021. Delayed child tax credit payment leaves parents fuming but IRS promises you should get it soon. September 27 2021 744 AM 3 min read.

So where is the September payment for the child tax credit. Technical issue delays some Advanced Child Tax Credit Payments until Oct 1 About 2 of the September payments were delayed. Oct 18 2021 1228 PM EDT.

That one impacted less than 2 recipients. The IRS has confirmed that an issue is causing late payments for some people. The IRS will use your 2020 or 2019 tax return whichever is filed later or information you previously entered using the non-filer tool to determine your eligibility for the child tax credit payments.

For this year only the Child Tax Credit is worth up to 3600 for children under the age of 6 and up to 3000 for children aged 6 to 17. Checks were supposed to be sent out on September 15 and millions of Americans were due to receive the cash days later. What if your Child Tax Credit payment is delayed.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. 15 some families are getting anxious that they have yet to receive the money according to a. IRS sending October installment of child tax credit after delay in September by.

Users will need a. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. N the 15th day of each month families across the United States are supposed to receive advance payments of their 2021 child tax credit.

Missing your September Child Tax Credit payment. As Families Report Delays In September Child Tax Credit Payment IRS Says Its Looking Into What Happened Syndicated Local CBS Pittsburgh 9222021 Amid the. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

The child tax credit extension scheme is due to end next year but several Democrats are keen to continue the program Credit. Parents eagerly expecting their third enhanced Child Tax Credit payment last week say they experienced a delay in getting the money as expected. Instead of calling it may be faster to check the.

IRS sends third child tax credit payments around 15 billion to 35 million families VIDEO 906 0906 How a couple living in. The IRS is understaffed and still working through processing tax refunds audits multiple rounds of stimulus payments and navigate changes made to tax laws during the pandemic. Some families said they eventually.

Annual Information Statement Ais Under Income Tax Act Ebizfiling In 2021 Income Tax Income Annual

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Nta Blog Advance Child Tax Credit What You Should Know Part Ii Tas

Submission Of Form 15 Ca And Form 15 Cb Under Income Tax Act In 2021 Income Tax Taxact Income

Diwali 2020 Happy Diwali Diwali Happy

Net Worth Tracker Template Net Worth Annual Worksheet Net Etsy Video Video Net Worth Total Money Makeover Money Makeover

What Is A Bone Marrow Transplant Types Procedure And Risks And Complications Involved In A Bone Marrow Transplant All Y Bone Marrow Transplant Spine Surgery

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tv Com

Online Gst Registration Registration Goods And Services Tax Credits

Labels For Australian Visas Won T Be Issued From September 1 It S A Move Designed To Streamline Visa Processing And Encoura Australia Visa Australia Melbourne

File Itr Now Income Tax Return Tax Return Income Tax

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Did Your Advance Child Tax Credit Payment End Or Change Tas

Sept 30 Is Last Date For Filing Ay 2019 20 Itr What You Need To Keep In Mind Tax Refund Filing Taxes Income Tax Return

Happy Tax Day Your Refund May Be Delayed Tax Refund Irs Money